News & Blog

21/11/16

Regulatory Insight

Building banking regulatory regimes in post-conflict countries requires industry engagement and a careful appraisal of risks. Here we tell you why.

Somalia

Most of the inflows into the country pass through Money Transfer Businesses (MTBs). There are few banks in the country as well, and other firms with hybrid money transfer business models also operate in the market. However, there is not a domestic and international payment and settlement system, which makes it possible to wire funds electronically with its attendant audit trail, hence the current material conduct risk concerns about the country’s monetary inflows.

The MTB’s share of funds inflow into the country is substantial. They are effective operators in the market and evolved a business system which is generally considered reliable and cost effective for those that use it. Whilst these MTBs play a critical role in the economy, and importantly, in the livelihoods of millions, they are not a substitute for the important financial intermediation role banks, and other deposit-taking institutions play in a country’s financial and economic development.

The question of regulating the industry is therefore a vexed one for the Central Bank of Somalia – the supervisory authority in this post-conflict fragile country. Critical to an effective regulatory regime is an understanding of the work of these different market operators, the existing and emerging material risks inherent in their operations, their size, business model, risk management, and operational complexities. An informed, risk-based approach to regulation requires an analytical framework which assesses individual and aggregate risk profile

of these financial firms with a view of assessing the risks they pose to the country’s financial system. This is a point which is often overlooked: without gathering relevant market intelligence on the operations of these firms through technical and consultative engagement, it would be difficult to set up and operate a supervisory framework which is targeted at the areas of material risks that pose dangers to the safety and soundness of the country’s financial flows.

A supervisory approach to regulation, therefore needs to take account the embryonic landscape of Somalia’s banking regulatory system, and key to this is identifying where these key vulnerabilities in the system lie to inform the right level of supervisory intervention. The advantage, and the resulting regulations, of this approach is that it retains stakeholder confidence, is proportionate to the scale and complexity of the financial firms, and targets material risk areas effectively.

The risk of a poorly designed approach to regulation is that it may be seen to be regulating businesses out of existence or imposing disproportionate and costly compliance burden on small operators which are critical to the subsistence of many millions, but which are not material risk entities. Policy makers need to be wary of a one-size-fits-all approach to regulation and should engage in good quality consultation processes early in their rule-making.

An effective supervisory approach should also try to balance the local realities and challenges, firms face in complying with the regulatory requirements, with the Central Bank’s overall safety and soundness objectives.This is best achieved through industry engagement and a careful appraisal of material risks.

21/11/16

Payments System Infrastructure for Somalia: A key growth opportunity

A Phoenix Strategy Consulting Insights analysis shows which type of a Payment System Infrastructure could work for Somalia. The operational, regulatory and design challenges are, however, considerable.

Most of the fragile post-conflict countries do not have a basic payments system infrastructure. A cash-based settlement system is prohibitively expensive to operate and risky, lacks system audit trail, does not have money multiplier effect and severely constrains economic development, limiting, for instance, the ability of individuals to make and receive payments; functional operations of bank accounts; the growth potential for banks, Money Transfer Businesses (MTBs), and companies.

Our analysis provides a high level summary of the architectural design and operation of a payment and settlement system in Somalia, the key regulatory initiatives to think about and the potential impact such a financial infrastructure would have on the country’s economic development. Our Insights analysis should be of interest to the Central Bank of Somalia (CBS) – the regulatory authority that is ideally placed to support the development of payments system infrastructure, but equally to Somali banks and MTBs (‘Hawalas’) operating in Somalia that may be exploring setting up an industry-led Payments Clearing House.

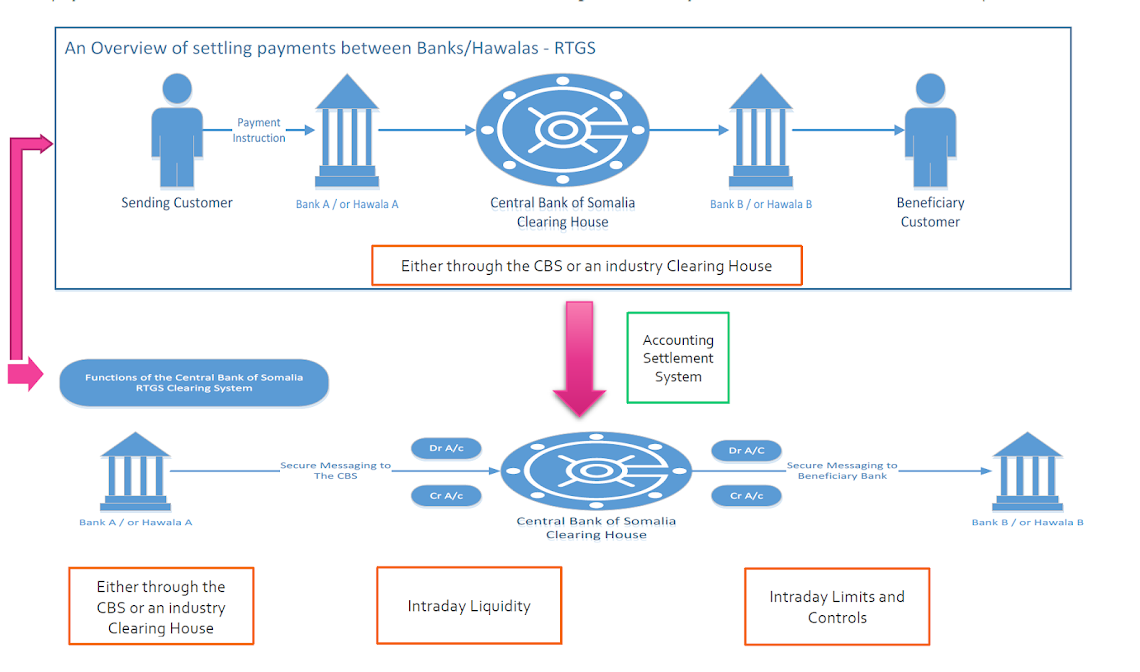

Real Time Gross Settlement (RTGS)

The RTGS system is one of the core elements of a country’s payment system infrastructure. It allows the net settlement of inter-bank payments. It is simple to operate, but complex in design and uses a real time accounting mechanism to clear payments between several banks and/or MTBS (‘Hawalas’). Diagrammatically, this is how an RTGS settlement operates:

Key uses:

High value and time-critical payments (e.g. when companies are settling payments that need to be received within a certain time frame).

Interbank clearing – for instance when large settlements are being made between two or more different banks/Hawalas.

Risk Management: It is easier to make and manage one large value payment, rather than multiple small payments.

Making it work for Somalia

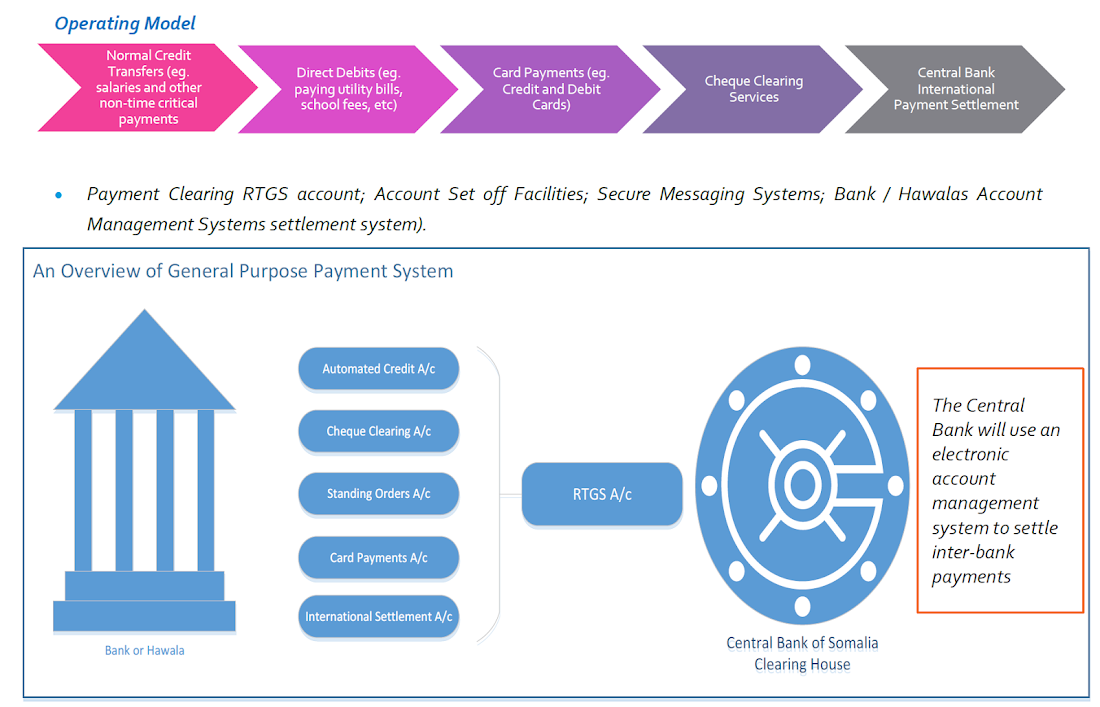

When a country’s payments systems infrastructure is at its most basic, or non-existent, as currently is the case for Somalia, an RTGS model may not necessarily open up the growth potential for payments clearing, nor would it cater for the different business models of market operators. A General Purpose Payment System (GPPS), supported by a Central RTGS system, could be another option that may transform Somalia’s economy.

General Purpose Payment System (GPPS)

GPPS is for low value, high volume transactions – salaries, company receipts, etc. It is a very cost effective system and opens up the country’s banking system much faster than a traditional RTGS. It puts the Central Bank of Somalia, or a relevant Clearing House, at the heart of the country’s domestic and international clearing system, thereby ensuring financial stability.

Where to start?

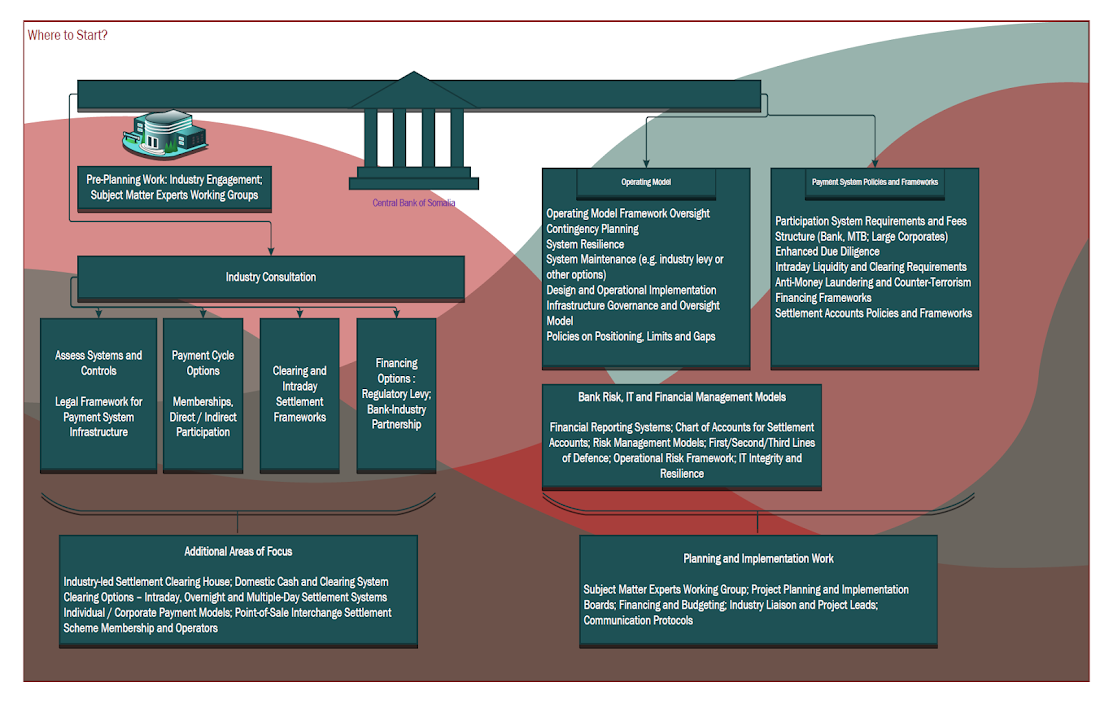

The implementation of a payment systems infrastructure in Somalia brings with it significant operational, regulatory and policy challenges that would need to be worked through carefully. We explain the key matters to consider: